Finance

Travel Tribulations: Brits feeling the pinch of upfront travel costs, with a quarter missing out on holidays with friends and family as a result

Published : 6 years ago, on

New research reveals the high upfront cost of travel is forcing anxious Brits to cut back on holiday spend overall

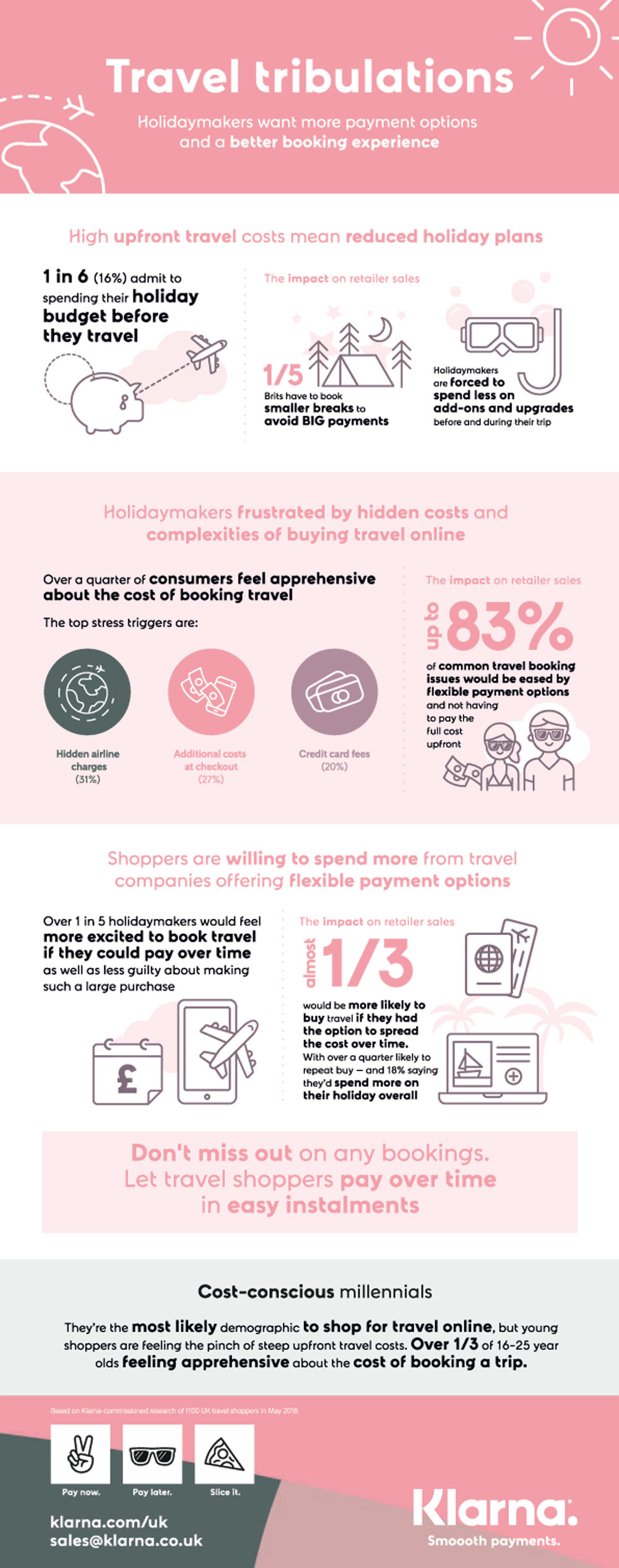

London: The need to pay for holidays upfront is causing widespread frustration among online shoppers, as 1 in 6 (16%) admit to spending their holiday budget before they travel, according to new research from leading payments provider Klarna.

The research of over 1000 UK consumers shows that the steep upfront costs of buying travel online is having a negative impact on people’s holiday experience. Nearly 1 in 5 (18%) travellers said they’re being forced to scrimp and save when they arrive at their destination, as well as having to settle for a lower standard of trip – with over 1 in 10 (12%) saying they’d prefer to upgrade, but can’t afford the upfront cost. It’s not only trip quality people are sacrificing; a quarter of respondents reported missing out on holidays with family and friends as a result of not everyone in the group being able to afford the lump payment.

And holidaymakers aren’t the only ones losing out; with nearly 1 in 5 (16%) consumers choosing to book smaller breaks to avoid big upfront payments, and 1 in 10 (12%) having decided not to buy a holiday at all over the worry about putting it on their credit card, travel vendors are missing out on sales over steep single charges.

The research highlighted how unexpected costs throughout the online purchase journey are a big source of frustration for shoppers; with hidden airline charges (31%), additional costs at checkout (27%) and credit card fees (20%) coming out as top stress-triggers. A lack of flexible payment options (17%) is also an issue, with 1 in 10 reporting feeling annoyed about having to pay before they travel.

Flexible payment options significantly improve consumer confidence, spend and loyalty

The option to pay for travel over time in instalments would encourage shoppers to go ahead and book as it would alleviate the stress of upfront payments. Interestingly, over 1 in 5 (22) said they’d feel more excited to book if they could pay over time, as well as less guilty about making such a large purchase (20%).

With staggered payments easing the financial burden of booking a holiday, the research revealed almost a third (31%) of consumers would be more likely to buy travel if they had the option to spread the cost over time, with over a quarter (26%) being more likely to repeat buy – and 18% saying they’d spend more on their holiday overall.

This presents a significant opportunity for travel retailers who don’t already offer flexible payment options, who stand to benefit from higher first time, repeat and add-on sales of travel products by affording customers the comfort and security of spreading the cost of their trip.

Commenting on the research, Luke Griffiths, Managing Director at Klarna UK, said: “The holiday countdown begins at the moment of booking, so browsing for and buying travel should be as exciting as packing for your trip or heading to the airport. Sadly, our research shows this isn’t the reality for many UK holidaymakers. It’s clear that travel providers need to do more to make shopping for travel online more accessible and enjoyable for consumers, from providing quality customer support throughout the purchase journey to offering deferred payment options at checkout.”

Download Klarna’s report – Travel commerce takes flight – for additional insight and advice for retailers:www.klarna.com/uk/business/products/travel/

-

Finance3 days ago

Phantom Wallet Integrates Sui

-

Banking4 days ago

Global billionaire wealth leaps, fueled by US gains, UBS says

-

Finance3 days ago

UK firms flag over $1.4 billion in labour costs from increase in national insurance, wages

-

Banking4 days ago

Italy and African Development Bank sign $420 million co-financing deal