Top Stories

Global venture capital funds continue strong performance

Published : 6 years ago, on

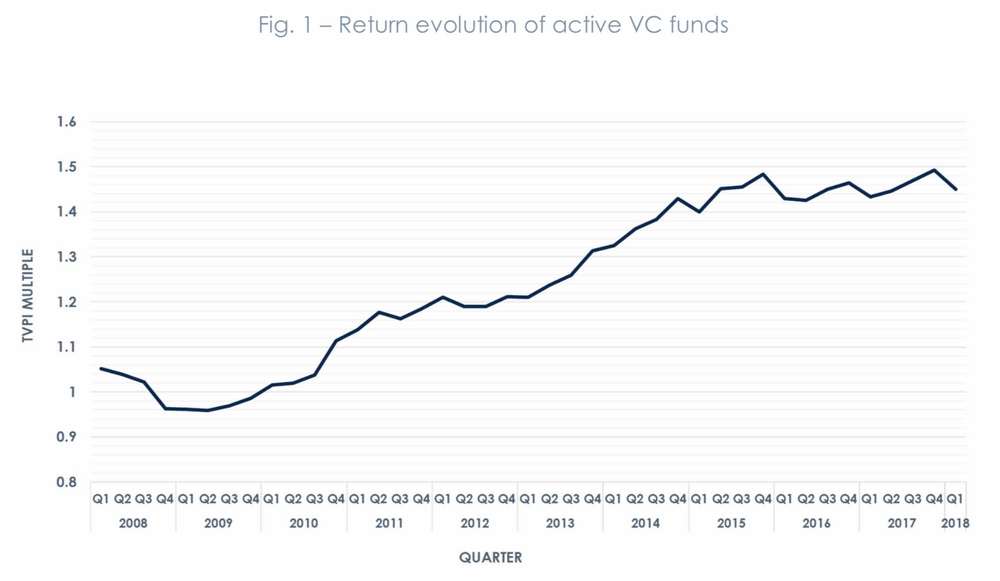

Paris – Venture capital funds globally continued their strong run of performance over recent years in the first quarter of 2018, with a near-record return of 1.45x, according to data from eFront, the world’s leading alternative investment management software and solutions provider.

The latest Quarterly Private Equity Performance Report showed that despite a small seasonal dip from the all-time high of 1.49x recorded in Q4 2017, venture capital returns continued their strong performance of the past three years in Q1, sitting at 1.45x. Multiples have been hovering between 1.40x and 1.50x since Q4 2014 and remain well above the long-term average.

eFront Quarterly Private Equity Performance Report highlights:

- VC funds recorded high multiples of investment (TVPI) in Q1 2018 (1.45x) – a small dip following the record high of 1.49x in Q4 2017 (see Fig. 1)

- Active global VC funds currently show an excess performance of 0.21x when compared to the average of 1.24x over the period 2008-2018

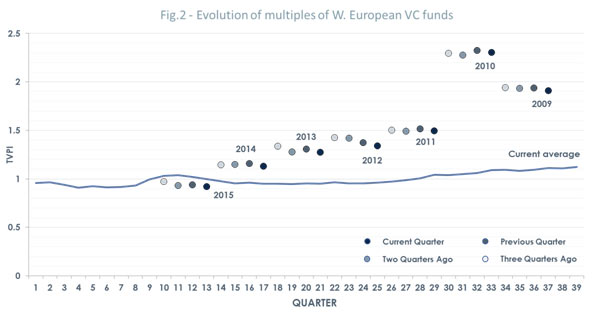

- Western Europe funds of vintages 2009-14 are recording strong outperformance of the long-term trend

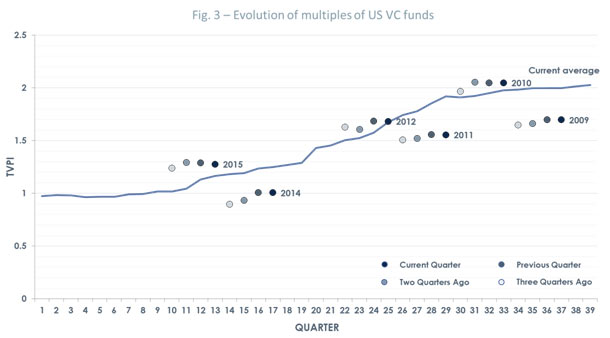

- US VC funds tend to underperform their long-term average, due in part to the skewing effect of the “golden years” in the 1990s

- Overall, fund selection risk (measured as the dispersion of performance between the top and bottom 5% of performers) continues to decrease, hitting 1.54x, compared with 1.96x at the end of 2015.

Tarek Chouman, CEO of eFront, commented:

“2018 started well for VC funds: multiples on invested capital remain close to their all-time high of Q4 2017, while selection risks and time-to-liquidity are close or back to their long-term average. For investors, falling selection risk is clearly good news, in admittedly a benign environment. However, the reduction of performance spread also implies that top funds could face increased difficulties generating outperformance. As the gap in performance between top and bottom funds decreases, VC funds converge towards the pooled average.”

Going in to 2018, US venture capital fund performance has remained steady, while European funds suffered a decline. While active US funds are benchmarked with exceptional historical years, active Western European funds benefit from the opposite phenomenon.

For Western Europe, the performance of vintages 2009-14 remains strong in comparison to the all-time average. Unlike their American peers, the average Western Europe fund does not include “golden years” prior to the dotcom crash, which could explain the significant outperformance. More recent vintage years have recorded declining multiples in Q1 2018, hinting at a possible cooling of asset prices.

The picture of US VC funds is more contrasted. Vintage years 2009, 2011 and 2014 all underperform the long-term average – as could be expected given the average is skewed by the strong years in the 1990s, 2010, 2012 and 2015 all seem to outperform.

For the full report, please click here.

About eFront

eFront is the leading pioneer of alternative investment technology, focused on enabling alternative investment professionals to achieve superior performance. With more than 850 limited partner, general partner, and asset servicer clients in 48 countries, eFront services clients worldwide across all major alternative asset classes. The eFront solution suite is truly unique in that it completely covers the needs of all alternative investment professionals end-to-end, from fundraising and portfolio construction to investment management and reporting. For more information, please visit eFront.com.

-

Finance3 days ago

Phantom Wallet Integrates Sui

-

Banking4 days ago

Global billionaire wealth leaps, fueled by US gains, UBS says

-

Finance3 days ago

UK firms flag over $1.4 billion in labour costs from increase in national insurance, wages

-

Banking4 days ago

Italy and African Development Bank sign $420 million co-financing deal