Banking

How Innovative Technologies are Transforming the Banking and Financial Industry

Published : 5 years ago, on

Ashwini Dave, Digital Marketing Expert at Acquire

The banking and financial services industry has changed dramatically over the years. About half a century ago, consumers regularly walked into a bank branch to withdraw or transfer funds, seek information on financial products, or get their issues resolved. The evolution of ATM brought about the first transformation in the banking industry, making 24-hr financial transactions possible. The arrival of the internet led to further developments in the industry, opening up multiple channels of engagement between consumers and their banks. At the same time, the physical aspect of banking started losing ground, with banks such Santander slashing their branch network by almost a fifth!

The reason?

According to data, customers are less likely to set foot in a branch, preferring to use their smartphone or computer instead. Santander reported a 23% decrease in branch transactions and a 99% increase in digital transactions over three years before deciding to cut down on physical branches and putting more focus on digital.

The Age of the ‘Amazon’

Big players like Amazon have made instant gratification the norm for customers, who expect the same level of service from all their service providers. Therefore, to remain competitive, the banking industry must rapidly embrace the latest technologies to create a frictionless, omnichannel experience for their customers. We are already experiencing one of the most useful customer communication tool, Chatbot.

Consider payments, one of the most basic applications of digital technology in the financial industry.

The transformation in this field was spearheaded by the evolution of physical instruments like credit cards and debit cards. However, physical cards are gradually losing favor, as most people have now moved on to mobile wallets and contactless payment options.

The ‘Data’ Game

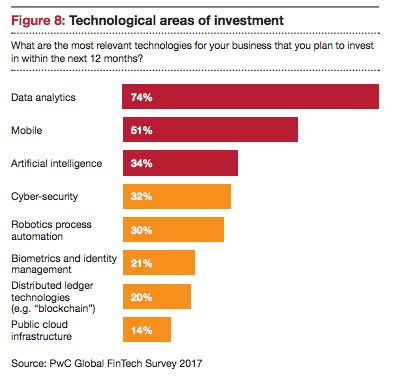

According to the PwC Global FinTech Survey 2017, the financial industry is heavily investing in data analytics to meet the evolving needs of its customers. The Worldwide Semiannual Big Data and Analytics Spending Guide from International Data Corporation (IDC) indicates a CAGR of 13.2% in big data analytics revenue between 2018-2022. By 2022, IDC expects the worldwide BDA revenue to be $274.3 billion. According to the report, the banking industry is one of the largest investors in big data and analytics solutions.

It’s clear that the banking industry has recognized the importance of the customer data stored on its servers. And, it is willing to invest in technology to exploit this data for personalized marketing and strengthening the security of their systems.

Know Your Customers Better

The financial industry sits on a treasure trove of data collected across various touchpoints, both physical and digital, over the years. And, just like various other industries, banks can use this data to know their customers better.

Take the example of American Express; with a “database of over 100 million credit cards globally, that account for over $1 trillion in charge volume every year.” The banking giant decided to make use of this data and created a sophisticated predictive model to prevent customer churn. By analyzing historical transactions and 115 other variables to forecast potential churn, Amex can identify accounts that are most likely to close within the next few months and take preventive action to keep these customers from leaving.

Big Data is also useful for personalized marketing or targeting customers based on their buying habits. Here, banking and other financial firms can collect data from the social media profiles of their customers and use sentiment analysis to understand their financial capacity and requirements before marketing suitable products to them.

Big Data and Automation

According to McKinsey, up to one-third of all the work in banks can be automated through technology, leading to reduced costs and elimination of human error to a large extent. JP Morgan Chase & Co. have built a data-based automation platform, also known as COIN. Employing a powerful machine learning algorithm, powered by a private cloud network, JP Morgan is using this platform to review complicated documents. Reportedly, the platform only takes a few seconds to complete regular tasks that previously required about 360,000 hours of work, without any errors.

Safety First

Various banks rely on big data and AI to identify fraud and prevent any potential scams. For example, banks can process large amounts of data to identify behavior patterns to reveal any potential risks among their own employees. They can also use data analytics to pinpoint fraudulent behavior and reduce the financial risks associated with digital transactions.

Immersive Technologies in Banking

Nowadays, customers no longer visit banks. They prefer to conduct most financial transactions from the comfort of their homes. However, certain situations demand expert help, or the customers may find it too tedious to fill out lengthy forms, such as claim forms, on their own. In such cases, advanced technologies such as co-browsing and screen sharing can help by enabling real-time connections.

Customers and agents can connect online through secure co-browsing sessions, where the agents can view the current resources of the customers while the customers can hide their confidential data like credit card details and other stuff.

But this is just the tip of the iceberg.

With 5G on its way, immersive technologies are becoming commonplace, and adoption of innovative technologies, such as augmented reality (AR) by the financial sector will lead to quick service and accuracy than ever before.

But the use of AR in banking is not new. Many banks and financial institutions have leveraged the power of augmented reality to curate new banking experiences for their clients.

In 2016, Mastercard partnered with Wearality to create an experience wherein users could buy golf clothes and accessories virtually, without doing anything in the real world!

In Oman, the National Bank of Oman offers an AR-enabled app to help its customers locate their nearest branch or ATM. The app also enables customers to uncover deals and offers as they walk around Oman, and uses their smartphone camera to combine real-life surroundings with an AR projection.

In India, Axis Bank launched the Near Me app, which enables users to search for nearby ATMs, finance-approved properties, and even dining offers in their areas!

But customers still want more.

As we already know, customers are no longer interested in visiting brick and mortar establishments for banking. Yet, branch banking is far from obsolete. According to research, “in areas featuring a branch, asset holdings are 2.5 times higher than unbranched areas.”

Yet, the majority of banks experience 90% of their interactions digitally. A logical step in the right direction could be the use of augmented reality and virtual reality to create virtual and hybrid branches for autonomous at-home banking.

Such technology will also be beneficial in offering high-quality services to clients in remote areas that lack qualified banking professionals.

Artificial Intelligence and Banking

Modern-day customers prefer to interact with their bank online or via mobile. However, most of these conversations are one-way. The customers are provided with a finite set of options that may or may not solve their problem.

So, if a customer wants to do something other than checking their balance or transferring funds or obtaining their transaction history, the chances are that he or she would have to contact the helpdesk for information. However, as contact centers are often overburdened, the customer may have to wait for a resolution. Often, call center agents may also transfer calls to other departments, leading to frustration in customers.

Enter AI, or more specifically, AI-enabled intelligent chatbots that communicate with customers through voice and text-based interfaces, enabling two-way digital communications.

In case you are wondering how an AI-enabled chatbot is different from a regular texting app, the answer lies in NLP that empowers a chatbot to comprehend natural language statements and respond to them intelligently.

Generally, chatbots in the financial sector can answer questions relating to the expenditure of certain items, the location of nearby ATMs or branches, enable instant transfers, suggest well-performing hedge funds, and even match customers with appropriate insurance products like the chatbot introduced by HDFC Life in India.

Take the example of Wells Fargo’s chatbot that uses AI to respond to natural language messages from users on Facebook Messenger. After registration, users can ask the chatbot questions such as how much they spent on food or travel the previous week, their most recent transactions, account balance, etc.

In addition to facilitating instant communication, chatbots save you money by enabling a high degree of automation in the customer services department. According to a study, 29% of customer service positions can be automated through chatbots, leading to $23 billion in savings for US businesses.

Chatbots can also be used to deliver pro-active suggestions to customers based on their transaction history or profile.

AI and Predictive Banking

Did you ever wish you owned a crystal ball that could give you a clear view of your finances?

With predictive banking, your wish may soon be granted.

Predictive banking is one of the most exciting trends in the financial industry. Today, banks finally have access to highly sophisticated technology to make use of the rich data in their coffers and give their customers tailored advice for the future.

With predictive analytics, banks can offer not only customer-specific financial advice but also make accurate customer risk assessments before approving loans and conduct behavior analysis to prevent frauds. Predictive analytics are also employed in the derivatives market to analyze the sentiments of different financial markets to make accurate predictions that help users make informed decisions.

Security Compliance in Digital Banking

Most banks are overhauling their traditional fraud detection systems with AI-based ones, as AI-enabled anomaly detection makes it easier and more cost-effective for banks to detect fraud.

In anomaly detection, the machine learning model is trained to sense the contents of banking transactions for standard patterns derived from historical data. Any deviations from this baseline behavior are notified to a human monitor who may accept or reject the alert. The behavior of the monitor further trains the model to understand whether the deviation was a fraud or an acceptable deviation.

Anomaly detection can also be used to analyze spending behavior, which allows the model to recognize any fraudulent shopping details. For example, a sizeable online transaction from a customer’s account that has a history of small purchases can be instantly recognized.

Banks may also employ predictive behavior analysis to identify potential threats amongst their own employees to prevent any scams or frauds.

In addition to payment frauds, banks are also privy to sensitive customer information or PII and must ensure data safety at any cost. Consequently, it is vital to employ secure e-forms for collecting user data that encode PII so that no other party can see the banking details. Developers can use differential privacy, which is “a mathematical approach that means AI models trained on user data can’t encode personally identifiable information.”

Conclusion

In the present times, every financial institution around the world is leveraging modern technologies such as cloud computing, data analytics, AI, machine learning, etc. to deliver customer-centric solutions. However, rapidly emerging technologies and evolving customer expectations mean that businesses in the banking and financial industry must continue innovating at break-neck speeds, lest they become obsolete.

In short, following trends is no longer going to work for financial institutions who wish to dominate the market. To truly capture the hearts and minds of their customers and secure their business, banks must tap into immersive technologies to create highly personalized customer experiences. They also need to make banking more convenient and intuitive by introducing two-way digital conversations and taking their services to customers’ homes through virtual and hybrid branches via augmented reality apps.

This is Sponsored Feature

-

Finance3 days ago

Phantom Wallet Integrates Sui

-

Banking4 days ago

Global billionaire wealth leaps, fueled by US gains, UBS says

-

Finance3 days ago

UK firms flag over $1.4 billion in labour costs from increase in national insurance, wages

-

Banking4 days ago

Italy and African Development Bank sign $420 million co-financing deal