Finance

FE Xcelerate: Unlocking the Thriving Startup Ecosystem of ASEAN and Vietnam

Published : 5 years ago, on

The ASEAN startup ecosystem has made great strides over the past years in both commercial innovation and investment activity. Since 2015, over $13 billion have been poured into the promised land looking for the best and brightest ideas1. In the center of this wave is Vietnam, home to a thriving community of entrepreneurs and innovators…

Overview of the ASEAN startup scene

The region has established itself as a hotbed for creators, disruptors and energetic businessmen in recent years. Across the Pacific Ocean, cities like Ho Chi Minh City, Manila, Singapore are racing against each other to become the next Silicon Valley of the Far East. Household names like Go-Jek, Grab and SEA have become local icons of which the up and coming startups model themselves after.

Chinese technology giants such as Alibaba and Tencent have bet big on the region, pouring in billions of dollars2. According to a study by Kroll and Mergermarket, US investors have accounted for 25% of investment in ASEAN startups since 2015. What is the secret behind the region’s attraction globally?

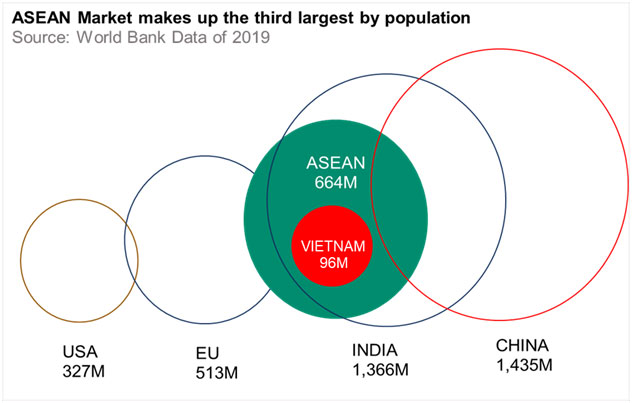

The 10 countries that make up the Association of Southeast Asian Nations (ASEAN) are home to 655 million people. Were ASEAN a country, it would be the world’s third-most-populous nation and boast the sixth-largest economy.Furthermore, market conditions are in place to enable startup growth. Over 50% of the population is under the age of 30and they aretech savvy. Internet penetration of the region has reached 65% while mobile subscription passes the 100% mark (vs population)3. A recent survey by Datareportal reports that 69% of the survey respondents have made an online purchase via a mobile phone4.

All eyes on Vietnam

As the 6th largest economy in ASEAN, Vietnam has all necessary attributes to become a major startup hub in the region.With a median age of 30 and 70% of the country’s 96 million people are smart phone users5, Vietnam is an attractive market made up of tech-savvy, digitally active consumers who are keen on trying out new products. The educated population also offers a large pool of low-cost, high-tech talent for local and regional firms.

Large corporations have increasingly seeking partnerships with the startup community. Viettel which is the largest state-owned corporation in Vietnam, has sponsored start-up events such as Viet Challenge and Viettel Advanced Solution Track. VPBank and TPBank also have offered preferential lending programs for startups, while UP Coworking has provided free facilities for qualified companies in exchange for business solutions.

According to Ernst & Young’s latest market research, Vietnam ranks 2nd in Southeast Asia in the startup ecosystem’s development rate.The total capital and number of technology-related deals made have grown six times in the last two years6.In the first half of 2019, retail and payment firmsheld the largest share of investment with 60 per cent. Trailing behind is emerging sectors such as real estate and logistics.By theend of the fiscal year, investment in startups will double last year’s figure, reaching $800 million.

Where the opportunity is for startups

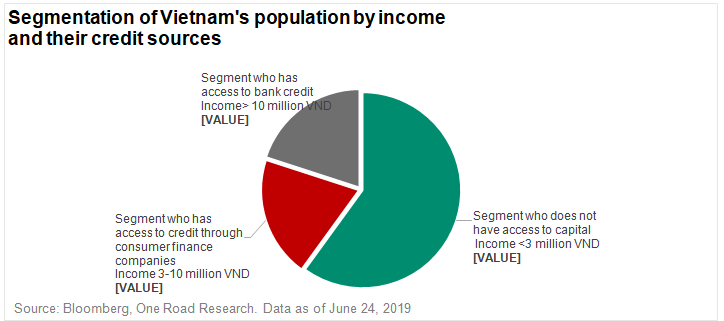

In the period between 2014 to 2018, Vietnam’s consumer finance industry has expanded rapidly at 59% annually7. This is the result of the government’s plan to provide financial service to the unbanked and underbanked population. It also provides a lucrative opportunity for both global and local startups to capitalize on one of Vietnam’s major megatrends.

As the leader of consumer finance industry, FE CREDIT has taken the first steps by holding the first of its kind business accelerator program, named FE Xcelerate. According to Mr. Basker Rangachari, Chief Marketing Officer, FE CREDITthe program’s aim is to partner with early stage fintech firms to revolutionize the organization’s business model and operations.

FE CREDIT is also the winner ofmany prestigious local and regional awards such as: “Top 10 Excellent Brands for Consumers,” “Top 10 Asia’s Most Trusted Brands” and “Best Consumer Finance Company Vietnam 2019.”

Why FE Xcelerate and who may join?

Prior to 2017, the company focused on growing its physical network. Today, FE CREDIT’s is well travelling on its path to digitization. Continuing its journey of finding digital solutions for all its business processes, FE CREDIT has announced the launch of its first-ever accelerator program, FE Xcelerate, in partnership with MEDICI.FE CREDIT intends to in-source and develop innovations by partnering with early-stage startups with disruptive solutions to address specific areas within FE CREDIT’s business line.

Some of the areas of collaboration with startups are building a customer platform for digital engagement, creating an omnichannel digital customer service and designing an on-demand platform to serve customers in real time. FE CREDIT aims to support and mentor both domestic and foreign Fintech startups, as well as provide them the opportunity to co-create business solutions which can be scaled into commercial products.

Once the product is approved by the committee, all license and transaction fees will be paid for under an official commercial agreement. Additionally, options for equity investment will also be a topic of discussion between FE CREDIT and FE Xcelerate’s selected fintechs.

To be eligible, startups must have a minimum viable product and should have been fully operational for at least last one year. Other required information includes details on management team, experience, number of employees, how long the company has been in business and the company’s funding. Applying startups may be from Vietnam or anywhere in the world.

Register for FE Xcelerate at: https://innovation.gomedici.com/fe-xcelerate/

Source:

2https://fortune.com/2018/06/21/alibaba-tencent-southeast-asia/

3https://aseanup.com/southeast-asia-digital-social-mobile/

45https://datareportal.com/reports/digital-2019-global-digital-overview

-

Finance3 days ago

Phantom Wallet Integrates Sui

-

Banking4 days ago

Global billionaire wealth leaps, fueled by US gains, UBS says

-

Finance3 days ago

UK firms flag over $1.4 billion in labour costs from increase in national insurance, wages

-

Banking4 days ago

Italy and African Development Bank sign $420 million co-financing deal