Investing

Infrastructure funds show strong performance

Published : 5 years ago, on

- eFront’s latest data shows that infrastructure funds in Europe outperform North American vehicles in terms of average performance

- eFront, the leading financial software and solutions provider dedicated to Alternative Investments, has published its latest research, showing that infrastructure funds globally deliver strong performance over long time periods, at low levels of risk.

Key findings:

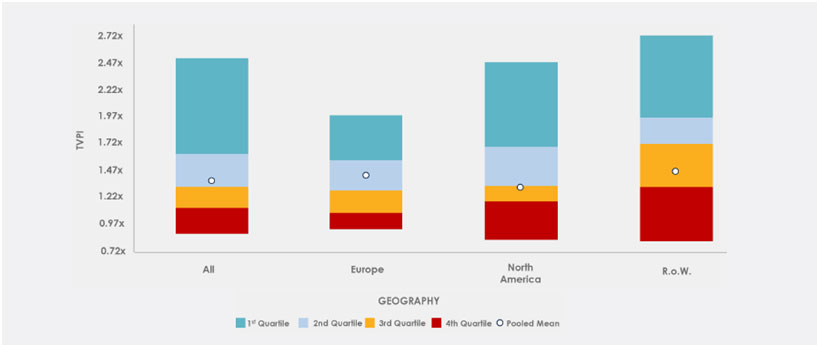

- On a pooled average basis, European infrastructure funds provide some of the highest returns, with a TVPI of 1.43x, compared with 1.32x for North American funds and 1.38x for all funds globally.

- European funds also offer low levels of risk; even bottom quartile fund generates the positive performance of 1.09x, while the worst performing fund delivers 0.94x.

- Globally, the bottom quartile fund reaches 1.16x, with no vintage year showing a performance of a bottom quartile fund below 1.05x.

- Funds belonging to the bottom 5% lost capital on aggregate, with a TVPI of 0.90x, but even here, more than a third of vintage years do not bear a loss of capital even for the bottom 5% of funds.

- Infrastructure funds are typically created for 13 to 15 years and their average holding periods are seven to eight years.

Analysis

On a pooled average basis, European infrastructure funds provide one of the strongest returns globally, with a TVPI of 1.43x, compared with 1.32x for North American funds and 1.38x for all funds globally (see Figure 1). European funds also offer a low level of risk; even funds in the bottom quartile show a positive performance, reaching the threshold of 1.0x and showing a range of 0.94x to 1.09x. By comparison, the bottom quartile of LBO funds sits at 0.72x to 1.12x.

Figure 1 – Multiples of invested capital of private infrastructure funds by region and quartiles

Source: eFront Insight, as of Q2, 2019

On aggregate globally, the pooled average TVPI of private infrastructure funds is of 1.38x and the median 1.33x. The bottom quartile fund delivers 1.16x. None of the vintage years tracked by eFront Insight shows a performance of bottom quartile funds below 1.05x. Even in the world of private real assets, this is an impressive achievement.

However, investing in private infrastructure funds still bears some risks. Not surprisingly, funds belonging to the bottom 5% lost capital on aggregate. Their multiple of invested capital is 0.90x, and of the individual vintage years tracked by eFront Insight, 63% bear a loss of capital. Still, this means that more than a third of years do not record losses on aggregate when specifically considering bottom 5% funds.

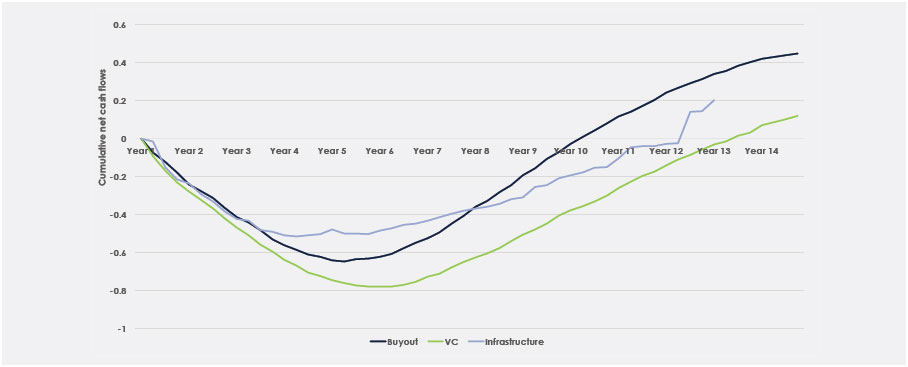

Infrastructure investing also benefits from rather predictable long-term streams of income.This does not mean that investors can avoid the usual J-curve associated with private markets investing (see Figure2). In fact, cumulated net cash flows reach -51.6% in Year 4 and, on aggregate, private infrastructure funds break even in Year 12. Infrastructure funds are created for 13 to 15 years and their average holding periods are seven to eight years. This explains the long duration of investments and the specific shape of the J-curve.

Figure 2 – Cumulative net cash flows of private infrastructure, buyout and venture capital funds

Source: eFront Insight, as of Q2, 2019

Although this could be at times analyzed as a risk, it is clear that the period during which funds show net negative cash flows is related to the long holding periods of assets. In that respect, the specific shape of the J-curve and the long duration are not a risk associated with infrastructure investing, but a dimension of this type of investment.

The logical conclusion is, therefore, that historically private infrastructure funds have shown fairly resilient performance and a very low loss ratio. However, they require a lot of patience and the ability to handle net negative cash flows for a fairly long time. One of the risks associated with infrastructure investing can appear from a sudden mismatch between the long commitment of an investor and an immediate need of capital. Another risk is that as infrastructure investing gains popularity, past performance and risk assessments become less relevant. As assets mature slowly, changes might appear later than in other private markets.

For the full report, click here.

-

Finance3 days ago

Phantom Wallet Integrates Sui

-

Banking4 days ago

Global billionaire wealth leaps, fueled by US gains, UBS says

-

Finance3 days ago

UK firms flag over $1.4 billion in labour costs from increase in national insurance, wages

-

Banking4 days ago

Italy and African Development Bank sign $420 million co-financing deal