Trading

THE SILENT VOTE

Published : 8 years ago, on

by Daniel Arguelles Tangarife, VP FX Desk Credicorp Capital Colombia

For those investors who have been actively trading and investing in global markets for more than a decade, it has become evident that traditional tools of analysis and decision making have changed dramatically. Technology, politics, economic sentiment and even trading psychology are evolving almost in real time. Generating consistent returns over time and finding efficient financial decision making methodologies has never been more difficult.

All around the globe, portfolio managers and traders are struggling to find new variables that will help them make better decisions within markets and be more assertive in their direction. Politics are a great example of how traditional analysis tools no longer represent neither market sentiment nor directional moves on global assets.

2016 has been the year of the unthinkable when it comes to political analysis. Brexit was the first of many political events that fully demonstrated that markets do not have sufficient tools to measure real political sentiment. Who would have thought United Kingdom voters would actually favor exiting the European Union? The reaction of global markets and the immediate weakness of the British pound proves traders and investors were not ready for such an event.

As the chart shows, the pound plummeted 11% after the Brexit and 7.5% thereafter, proving the result came in as a surprise; currently there are no models or methodologies that can safeguard investors for such an event.

Only a couple of months later, the U.S. election became one of the most incredible political events in the latest years. A single entrepreneur with no political experience defeated the enormous political machinery of a highly-experienced candidate. Traditional politics, advertising campaign, wealthy and powerful benefactors have proven to be useless to convince ordinary voters. Once again, election polls cannot be trusted when it comes to making financial decisions. Over and over financial markets have been completely unprepared to absorb political turmoil. This situations are known as “nonevents”. As the following chart shows, the incredible volatility of global markets in the past couple of weeks demonstrates the need of new resources amongst portfolio managers that allow them to include all these variables in their models, to be proactive rather than reactive.

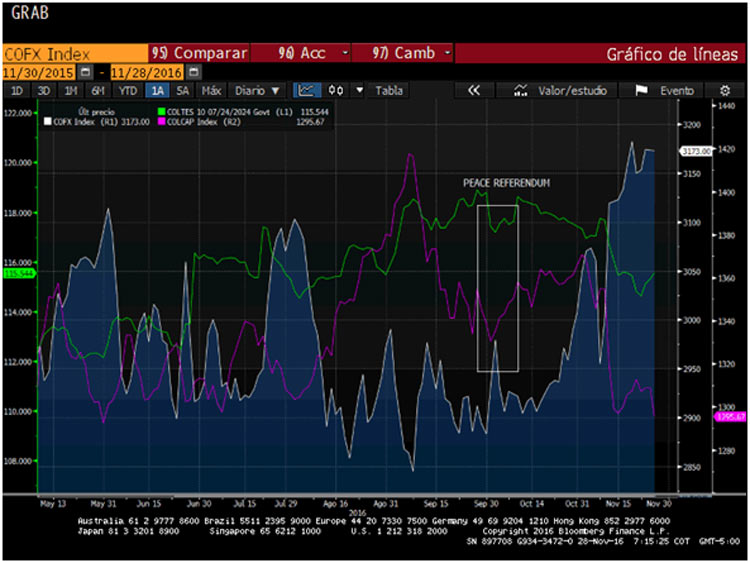

The situation for emerging markets is no different. Colombia, one of the most prominent emerging markets in Latin America, has suffered its own political deception in 2016. After fifty years of civil war and countless victims, the civil society voted no against the agreed peace treaty proposed by the Colombian government and the rebel forces. Once again, the unthinkable happened. The Colombian peso, local debt and the main equity index reacted accordingly.

Recent political events show that voter’s true opinion is not being acknowledged by traditional channels and therefore not being priced in the global assets. How is it possible that financial markets, inherent discounters of every piece of available information, were unable to prepare for political turmoil?

Several questions arise: Is it fear to speak freely that makes polls go wrong? Is it reluctance to express ideas just because they might seem a little extreme? Is it complete distrust in the political system expressed as a counter vote against traditional candidates or ideas? Are social networks becoming the new channels of information? Nobody knows for sure. Whatever the reason might be, there is clearly a silent vote and opinion amongst society that is not being perceived by financial markets.

Here is a theory; despite the fact the world is certainly not becoming more radical in terms of political posture, the discomfort of ordinary citizens in many countries towards traditional political parties and ideas, is evident. This expression becomes the silent vote, and it certainly feels like a massive force. Therefore, it should be considered by portfolio managers and traders when it comes to pricing and valuing global assets. It may probably increase the effectiveness of the trades and the potential return of the portfolios.

The new world political scenario presents itself as a source for volatile markets. Financial crisis are occurring more frequently, technology is a fundamental tool for traders and historic volatility is spiking. Add political turmoil to the equation and the necessity for new approaches to portfolio management is mandatory. Social thinking and nontraditional providers of political sentiment, such as social networks, must be somehow placed in the new optimization models.

Finding a way to add these nonevents into financial modeling(like the real political sentiment into investing models) will make financial decision making a little more accurate. Traders and investors are relying heavily in the data provided to them instead of making their own, showing the catastrophic results in the markets. The Italian referendum and the French elections are still to come in the near future, traders and portfolio managers should be prepared for the unthinkable. All lessons from the past are right on the table.

-

Finance3 days ago

Phantom Wallet Integrates Sui

-

Banking4 days ago

Global billionaire wealth leaps, fueled by US gains, UBS says

-

Finance3 days ago

UK firms flag over $1.4 billion in labour costs from increase in national insurance, wages

-

Banking4 days ago

Italy and African Development Bank sign $420 million co-financing deal