Interviews

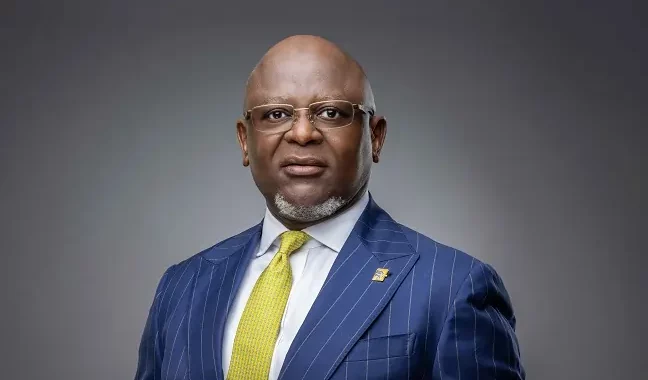

Dr Adesola Adeduntan: Establishing FirstBank as the Dominant Player in Digital Banking Propositions

Published : 1 year ago, on

Dr Adesola Adeduntan is the CEO of FirstBank Group, the commercial banking arm of FBN Holdings Plc, comprising FirstBank Nigeria and its UK, DRC, Gambia, Sierra Leone and Guinea subsidiaries, to name a few. FirstBank Group’s transformation programme, under his leadership, has enabled the bank to achieve significant business expansion: growing customer accounts from about 10 million in 2015 to over 42 million (including digital wallets), becoming the second largest issuer of cards in Africa with over 12 million to date, and onboarding almost 22 million active customers on digital banking platforms.

Dr Adeduntan is a philanthropist and leader with a keen interest in providing platforms for developing other young leaders. He is also a member of the Sigma Educational Foundation, focused on enhancing the quality of the tertiary education system in Nigeria; a member of the Steering Committee of the Private Sector Coalition Against COVID-19 (CACOVID) in Nigeria; a member of the Governing Council of the CIBN, and a member of the Board of Lagos State Security Trust Fund.

When he sat down with Wanda Rich, editor of Global Banking & Finance Review, he reflected on how FirstBank has evolved over the years to maintain its position as Nigeria’s leading financial services solutions provider.

“Today, when I look at FirstBank and compare it with what it looked like in 1996, when I had my first professional contact with the bank, I would say its transformation has been unprecedented,” he said. “In 1996, only a handful of staff could use a computer because banking itself was very traditional in those days. Those were the days of batch computing, where all the branches put their vouchers together and the processor basically punched in the data from a dedicated computer room. Today, almost every employee uses a computer or electronic device to perform their duties.”

Over the last 129 years, FirstBank has successfully reinvented itself and transformed from a largely brick-and-mortar setup to the brick-and-click financial institution it is today. He noted how this transition underscores not only the bank’s huge investments in technology but also a fundamental shift in the bank’s delivery model in serving its teeming customers. “FirstBank has undertaken an extensive transformation of its back-end processes, technology infrastructure and customer interface experience, as well as reporting and governance frameworks to better serve the needs of its stakeholders.

“At FirstBank, we have empowered our customers with several digital channels and capabilities, including FirstMobile, Lit App, FirstOnline, *894# (USSD) banking and FirstDirect transaction banking platforms, to enable them to perform banking transactions from the comfort of their homes and offices. Today, over 90% of all our customer-induced transactions happen on the digital channels. This is a testament to the successful evolution of our delivery channels.”

In addition, FirstBank has pioneered the first fully digitised branch in Nigeria’s banking landscape with the introduction of the Digital Xperience Centre (DXC), where it leverages modern technology such as humanoid robots and artificial intelligence to enable customers to perform self-service banking transactions. Through self-service kiosks, customers can request and pick up their ATM debit cards in less than three minutes.

“Leading other players in the Nigerian market, FirstBank has done the most to advance financial inclusion in Nigeria through the FirstMonie Agent Banking Network, with over 218,000 agents located in 772 of the 774 local government areas in the country,” Dr Adeduntan said. “On the back of this, the bank has been able to bring banking services much closer to customers in rural and underserved communities.

“At FirstBank, we see ourselves as much more than a bank; we are also a critical partner in the success of our customers and the markets that we serve. As such, we will continue to evolve to meet not just the current expectations of all our stakeholders, but also their future needs that are yet to appear on the horizon.”

The FirstBank DXC is an impressive reinvention of digital banking solutions. He elaborated on the benefits it brings to customers and how it reflects the future of banking in Nigeria. “The DXC reflects the bank’s view on the near-future possibilities in financial services delivery, given recent technological advancements. It also underscores the central role modern technology is playing and will play in the bank’s operations and service delivery strategy, as well as the level of investments we have made in this space. The DXC is a fully automated, interactive digital branch that was first launched in Lagos, Nigeria in 2021 and has, since then, redefined customers’ banking experience through a world of digitised self-service. The second DXC outlet was just recently launched in August 2023 at the University of Ibadan, Oyo State, Nigeria.

“The DXC has no human staff and is fully equipped with digital screens, self-service terminals, card-issuance kiosks, ATMs, humanoid robots, video banking and artificial intelligence, as well as several other digital-led and assisted gadgets and capabilities. These digital solutions allow customers to take charge of their banking transactions, making self-service a lot easier while improving turnaround time.”

According to Dr Adeduntan, the DXC has been received with tremendous positivity by all customer segments, especially retail customers, and the bank has plans to roll out more outlets in the year. He went into further detail about how the DXC’s innovations enhance customer experiences and contribute to the bank’s digital transformation strategy. “In line with one of the bank’s strategic priorities to build a world-class, customer-first organisation, the DXC is already revolutionising retail customers’ experience in Nigeria,” he expounded. “Some of the benefits that this innovative solution will afford our customers include, but are not limited to, 24-hour convenient and unassisted availability of banking services; increased banking appeal to the tech-savvy, youthful demography; enhanced customer experience via improved service turnaround time and operational efficiency, due to the simplification of key customer transaction journeys, and a holistic redefinition of the customer experience because of the elimination of human interface in the service delivery chain.”

With CSR filling an integral role in FirstBank’s business strategy, Dr Adeduntan went on to share some examples of the bank’s recent CSR initiatives and their positive impacts on the communities it serves. “At FirstBank, we value our relationships with all our stakeholders, especially the communities where our businesses operate,” he said. “Therefore, we are very deliberate in how we engage our host communities to ensure shared prosperity and long-term sustainability of the environment. In this regard, FirstBank’s CR&S (corporate responsibility and sustainability) framework is hinged on three strategic pillars, namely: Education, Health & Welfare; Diversity & Inclusion, and Responsible Lending, Procurement & Climate Initiatives.

“Each pillar is made active through the implementation of well-coordinated programmes and initiatives that enable the bank to fulfil its sustainability agenda and priorities. These initiatives include SPARK, an acronym for Start Performing Acts of Random Kindness, which is a values-based initiative designed to continuously reignite the bank’s cherished moral values of compassion, civility and charity. During the 2022 SPARK Amplification and CR&S Week, the bank implemented over 23 projects across eight countries and impacting over 54,000 people and 80 charity organisations. Since its inception, the SPARK initiative has reached over 50 million people.”

Then there is the FutureFirst programme, FirstBank’s vehicle for promoting the triple benefits of financial literacy, career counselling and entrepreneurship among the younger generation. “In partnership with JAN (Junior Achievement Nigeria), FutureFirst is a unique programme that equips high school students with the necessary financial knowledge and skills to enable them to make better money choices and put them on the right track towards financial wellbeing,” Dr Adeduntan revealed. “In 2022, over 260,000 students benefitted from the bank’s financial literacy and entrepreneurship engagements.

“Additionally, over the last eight years, FirstBank has been a proud sponsor of JAN’s flagship National Company of the Year Programme, through which senior secondary school students are taught about the rudiments of starting and running a business, as well as product development and marketing. This programme provides critical hands-on entrepreneurial experiences for youth, preparing them to build sustainable businesses. FirstBank also sponsors the winners of the NCOY programme to the annual African Company of the Year Competition.”

Finally, through its partnership with the NCF (Nigeria Conservation Foundation), FirstBank actively contributes to the protection of biodiversity and the reduction of greenhouse gas emissions. “The bank’s sponsorship of the annual activities of the NCF, aimed at wildlife preservation and climate change control, helps the Foundation achieve its overarching objectives. In addition, over 30 schools across Nigeria have been reached by our climate change and environmental sustainability advocacy.”

The bank’s CR&S approach is well aligned with both local and international best practices, as advised by the NSBPs (Nigerian Sustainable Banking Principles), the IFC PSs (International Finance Corporation Performance Standards) and the EPs (Equator Principles). “Our chosen approach enables the bank to contribute directly to at least seven out of the seventeen United Nations SDGs (Sustainable Development Goals),” Dr Adeduntan said. “In implementing the CR&S framework, the bank is guided by three broad considerations, namely citizenship, stakeholder management and impact management. These guidelines ensure the bank remains a responsible corporate (and global) citizen, balances the objectives of all our stakeholders as it conducts its business, and minimises the adverse effects of its activities on the environment for the common good.

“The bank also contributes to sustainable economic growth and development by constantly seeking to provide innovative products and services that empower its customers to achieve their financial and other lifestyle goals. In addition, the bank has fully embedded an ESGMS (Environmental, Social and Governance Risk Management System) into all credit decisioning processes, as well as adopting sustainability reporting to measure its progress on the sustainability journey.

“Furthermore, the bank is committed to decarbonising its operations, including those of its value chain, in a bid to accelerate its transition to net-zero carbon emission status. This is being done in line with the standards of the PCAF (Partnership for Carbon Accounting Financials) and other international agencies, such as BII (British International Investment) and Proparco.”

He explained that FirstBank has a clear governance structure around sustainability, culminating in the creation of the bank’s Corporate Responsibility and Sustainability Committee. “The Committee, chaired by our Executive Director and Chief Risk Officer, ensures that matters relating to sustainability are given the highest visibility within the FirstBank Group while also entrenching the right ‘tone at the top.’ The bank is firm in its belief that sustainability creates a clear pathway to creating long-term value for all stakeholders and remains committed to this journey.”

Dr Adeduntan moved on to discuss FirstBank’s ‘You First’ brand promise that, rather than just being a cliché, reflects the pivotal role that customer-centricity plays in its overall strategy as an institution. “Customer-centricity is one of the bank’s four espoused core values – the others being entrepreneurship, professionalism and innovation – that guide and shape the behaviours of every FirstBanker.

“Given this context, we are constantly exploring opportunities to simplify our processes and make the customer experience a lot more wholesome. To do this, the bank leverages cutting-edge technologies to automate key processes in a bid to significantly reduce both the transaction processing time and the customers’ wait time. To demonstrate our customer-centric focus, the bank was the first to introduce the instant ATM card issuance service into the Nigerian market, which made it possible for customers to pick up their debit cards within minutes at any branch of the bank. FirstBank has taken this service a notch higher with the introduction of the self-service kiosks.

“Also, to ensure that the bank is in sync with the rapidly changing customer preferences in our dynamic industry, we have established a Digital Innovation Lab to curate forward-looking and innovative ideas that meet the needs of every customer segment. FirstBank also leverages insights from data analytics to detect and anticipate changing customer patterns to enable the bank to tailor its products and offerings to specific customer segments’ needs.”

As opposed to a ‘one-size-fits-all’ approach in dealing with its customers, the bank’s six strategic business areas – retail, commercial, corporate, public sector, global private banking and wealth management, and international banking – are supported by well-resourced product groups that ensure the right product-customer fit for each of the bank’s service offerings by utilising unique insights from that customer segment.

In the corporate banking sector, particularly in terms of financial services, project finance and foreign exchange, FirstBank is proactive in maintaining its competitive edge. “The goal for our corporate banking business remains to be a ‘trusted advisor’ to our clients, and we are guided by this objective in our business and investment decisions for this customer segment,” Dr Adeduntan said. Clearly this approach has paid off, considering that FirstBank has again emerged as the Best Corporate Bank – Western Africa at the 2023 Global Banking & Finance Awards.

“As a bank, we maintain our competitive edge in the corporate banking space in various ways. First, we ensure our people have the right skill set and technical competence to support the aspirations of our corporate clients. This results in a deep understanding of the clients’ businesses and their specific growth journeys.

“With this understanding, we can leverage our extensive industry knowledge to provide bespoke financial services that help our corporate clients achieve their goals,” he continued. “Similarly, the bank’s robust balance sheet means that it can better support the financing requirements of these clients using innovative financing vehicles and products.

“At FirstBank, we are able to help our clients navigate the current challenging operating environment with sophisticated treasury (FX) products and solutions that improve our clients’ access to foreign exchange while simultaneously assisting them in managing their exchange rate risks. The bank also leverages its technology and digital capabilities to deliver an unrivalled customer experience to its corporate customers.”

When it comes to the ever-increasing significance of technology in modern banking, FirstBank is leveraging digital transformation to enhance payment and collection platforms for its corporate banking clients, as Dr Adeduntan explained. “In line with our deep understanding of the corporate banking space and the role an effective cash management function plays in the overall success of these big clients, FirstBank has developed a segment-specific platform called FirstDirect that assists our corporate clients to improve overall efficiency in liquidity management through a highly secure and integrated platform.

“FirstDirect is a robust integrated platform that offers corporate clients several features such as payments, collections, supply chain finance, receivables finance, host-to-host, mobility, trade, etc. through a single interface. This platform enables our clients to have secured, end-to-end automation of critical processes such as vendor and salary payments, liquidity management, collection of sales proceeds, trade transactions processing and other finance and treasury activities.”

He also discussed the easy integration of FirstDirect into the corporate client’s existing ERP (enterprise resource planning) application. “This eliminates interruptions to established internal processes while improving oversight and the quality of outcomes of the finance function.

“FirstBank remains committed to its corporate banking clients and will continue to make necessary investments, including in technological support, to strengthen the bank’s value proposition to the corporate segment.”

As a leading financial institution in Nigeria, FirstBank takes steps to support financial inclusion efforts and promote access to banking services for underserved populations in the region. “As Nigeria’s oldest and most successful banking brand, FirstBank has always partnered with the government and regulators in driving and achieving their fiscal and monetary policy objectives. In this regard, FirstBank has helped scale financial inclusion in Nigeria in at least three distinct ways. First, with about 800 business locations, FirstBank has one of the largest retail footprints in the country and is the most known bank brand across Nigeria. This is especially true in rural areas where most other competitors are conspicuously absent.

“Second, with over 218,000 agents, FirstBank’s FirstMonie Agent Banking Network is the largest bank-led agent network in Africa. In addition, at least 63% of these agents are in rural or semi-rural locations where they play very crucial roles in bringing financial access and services closer to the underserved communities. The FirstMonie network also provides both direct and indirect employment to rural dwellers, thereby contributing significantly to raising their economic status.

“Additionally, the bank has leveraged the increase in mobile telephone penetration in Nigeria to offer seamless digital financial services to rural dwellers through our USSD (*894#) offerings. Currently, almost 15 million subscribers are enrolled on the bank’s USSD platform.”

The banking industry in West Africa has faced both opportunities and challenges in recent years. As the premier financial institution in West Africa, FirstBank has been at the forefront of leading change in the sub-region and played a pivotal role in the evolution of its financial and payments landscape. Wanda asked for Dr Adeduntan’s perspective on some of the key trends shaping the industry’s future, and how FirstBank is positioning itself to navigate these challenges. “In my opinion, the biggest trend that is shaping the future of the banking industry is digital transformation,” he replied. “The spate of technological advancements is leading to rapid changes in customers’ tastes and expectations. Technological advancements have also made it possible for non-bank players, such as telcos, fintechs, etc., to compete with traditional banks, especially in the payments space. At FirstBank, we have adopted a perspective that sees technology not just as an enabler but as a business itself. Over the last few years, we have made significant investments to repurpose our technological architecture and make it future-proof to support our business aspirations.”

The other factor he sees shaping the future of the industry is regulation. Given the lack of uniformity in regulatory standards, and indeed in national payments infrastructure across the West African sub-region, it can be challenging to scale business operations at the same pace. “We may end up with a future where some markets will be much more advanced than others within the same sub-region,” he predicted. “As a socially responsible organisation, we have adjusted our pace in line with that of regulators in our markets, while at the same time maintaining a partnership posture that enables us to facilitate and contribute to the direction of regulatory developments by leveraging our rich expertise.

“As the continent gears up for the operationalisation of the AfCFTA (African Continental Free Trade Agreement), there is bound to be a surge in formal intra-African trade volumes, which will necessitate more effective payments and trade support services. At FirstBank, we are rapidly acquiring the right capabilities to take full advantage of the AfCFTA and developing innovative payment products, such as First Global Transfer, to serve the broader needs of transacting African parties.”

Dr Adeduntan concluded by highlighting the bank’s aspirations and goals for the coming years. “We are currently executing our 2020–2024 strategic plan, which will elapse by the end of next year. Thereafter, we will go into the next strategic horizon for our franchise for 2025–2029. While I will not want to pre-empt that effort, given the significant mileage we have made within the current strategic cycle, the next five years will see us consolidating on the achievements of the last five and doubling down on our growth journey.

“In line with our vision to be ‘Africa’s Bank of First Choice,’ we are keen on extending our footprints both on the continent and in Europe to better serve Africans and African businesses and thereby empower them to achieve their dreams. Already, we are repositioning our global private banking and wealth management business to serve a broader African HNI (high-net-worth individual) clientele, offering them sophisticated wealth management products.

“As an institution that has existed for almost 130 years, we are adept at reinventing ourselves to remain relevant and serve every generation, no matter what its needs are. I am confident that the next five years will be no exception.”

-

Finance3 days ago

Phantom Wallet Integrates Sui

-

Banking4 days ago

Global billionaire wealth leaps, fueled by US gains, UBS says

-

Finance3 days ago

UK firms flag over $1.4 billion in labour costs from increase in national insurance, wages

-

Banking4 days ago

Italy and African Development Bank sign $420 million co-financing deal